Important Statutory due dates for Company annual filing for FY 2021-22. In 2019 that trend continued as Malaysias GDP reached an estimated 3653 billion with 43 growth.

How To Fix A Mistake In Your E Filing For Malaysians By Juinn Tan Medium

There are exemptions from Sales Tax for certain persons eg.

. Due to federally declared disaster in 2017 andor 2018 the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes. Doerre June 14 2019 1045 am. Low Taek Jho born 4 November 1981 often called Jho Low is a Malaysian fugitive businessman wanted by authorities internationally in connection with the 1Malaysia Development Berhad scandal 1MDB scandal.

Rosmah has sought to remove a high court judge who is set Thursday Sept. If you are filing your taxes in 2021. Used to facilitate employee tax filing and provided to each.

Must provide a copy of a current police firefighter EMT or healthcare worker ID to qualify. Yes None at this time. April 15 2023 to claim 2019 Tax Refund and for 2018 until April 18 2022.

ITR Filing Online for FY 2021-22 AY 2022-23 Know who should file income tax returns for FY 2021-22. Same as the filing Same as the filing due date Same as the filing due date due date Yes Yes Yes Yes No Yes None at this time but the Minster of Finance is studying this issue. For further inquiries please contact the nearest tccm office.

Understand if you are liable to file the return. This relief is automatic taxpayers do not need to file any additional forms or call the IRS to. The penalty for filing late is 5 of the taxes you owe per month for the first five months up to 25 of your tax bill.

Jika ini adalah kali pertama anda menggunakan e-Filing tekan Tidak dan lakukan log masuk Kali Pertama atau semak semula No. Lanjutan daripada itu pengeluaran STOKC juga akan. For all other back taxes or previous tax years it.

Must provide a copy of a current police firefighter EMT or healthcare worker ID to qualify. Yes the proposed effective date is 1 Jan 2020 PwC Asia Pacific VATGST Guide 2019 6. SSM invoked Sec 308 to winding up the company on 2015 and this process takes time.

Singapore has set up its legal team to respond to Malaysias application. This relief applies to all individual returns trusts and corporations. A specific Sales Tax rate eg.

Evidence of payment must accompany the return. Valid for an original 2019 personal income tax return for our Tax Pro Go service only. Kad Pengenalan Baru anda.

Contohnya dalam tahun 2019 anda berkerja dengan 3 buah syarikat. Delayed filing of GST attracts Late Fees. The Joint Commissioner Labour in this letter Dt03-10-2019 has directed the company to attend a meeting on 14-10-2019 along with remakes on my.

Rule 1 8 of the Code of Civil Procedure Code deals with the particulars of the plaint and Rule 9 deals with the. Had potongan untuk bahagian ini adalah RM5000 dan ibu bapa mestilah tinggal di Malaysia. Meanwhile for the B form resident individuals who.

Mulai 18 Mac 2019 Lembaga Hasil Dalam Negeri Malaysia LHDNM tidak lagi menerima permohonan untuk Sijil Taraf Orang Kena Cukai STOKC. Forms to be Used While Filing the ITR. Kindly be inform that all claims shall be filed online through e-tribunal system at httpsttpmkpdnhepgovmy and filing at counter by appointment only.

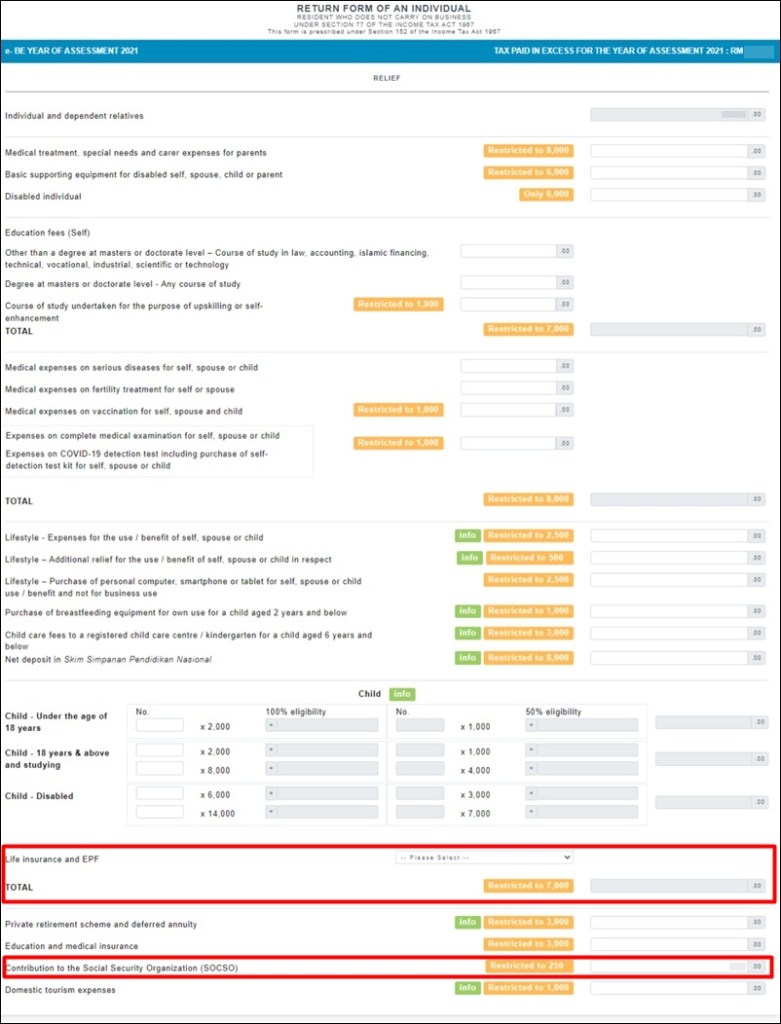

Scared by their court tactics I pay each summons RM300 for every threaten. Read todays most read article on London Stock Exchange and browse the most popular articles to stay informed on all the top news of today. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2020 for manual filing and 15 May 2020 via e-Filing.

We apologies for any inconvenience caused. A plaint includes only the material facts in a very short and precise way. No cash value and void if transferred.

The 2019 income tax filing and payment deadlines for all taxpayers who file and pay their Federal income taxes on April 15 2020 are automatically extended until July 15 2020. On 14 March 2019 Malaysia and Singapore agreed to mutually suspend the implementation of their overlapping port limits which effectively represented. Valid for an original 2019 personal income tax return for our Tax Pro Go service only.

In this case you must file the ITR before 31 st of September. According to the document organisations are requested to issue official tax exemption receipts only for donors who have provided all required particulars. Income Tax Department has notified 7 various forms up till now ie.

This is the income tax guide for the year of assessment 2019. He is responsible for being the mastermind of the massive fraud which prosecutors allege was a scheme to siphon US45 billion from 1MDB into Lows. Oleh itu bilanggan penggajian adalah 3.

Not submit the Form E on 2014 or not update the sale prediction on 2012 or etc. If your income is more than Rs 1 crore your account books should audited according to the ITR laws Section 44AB. Rosmah Mansor wife of former Malaysian Prime Minister Najib Razak waits for lift as she arrives at Kuala Lumpur High Court in Kuala Lumpur Malaysia on June 18 2019.

Form ITR 1 to ITR 7 for filing Income east. Also Interest has to be paid on late payment of tax. 1 2022 to deliver a verdict in her graft trial citing loss of confidence after an alleged guilty.

Panduan lengkap untuk cara-cara mengisi e-filing lhdn borang BE atau borang nyata cukai bagi individu yang bekerja dengan majikan. This was highlighted in the revised Guidelines for Application Of Approval Under Subsection 446 Of The Income Tax Act 1967 dated 15 May 2019. The timely tax filing and e-file deadlines for all previous tax years - 2020 2019 and beyond - have passed.

A freelancer can use the form ITR 4 while filing the tax returns. Waived off completely if filed between the period from 19th December 2019 to 10th January 2020. At this point you can only prepare and mail in the paper tax forms to the IRS andor state tax agencies.

Registered manufacturers who acquire or import raw materials to be. 030 Malaysian ringgits MYR per litre is applicable to petroleum products. Order VII of the Civil Procedure Code deals with the plaint.

There after my daughter filed complain before Labour Commissioner on 16-09-2019 duly enclosing voluminous e-mails for services rendered by her. Malaysia industrialised rapidly over the 20th century as it transitioned from a reliance on traditional mining and agricultural sectors to modernise its business infrastructure. However from time to time the income tax contact me for small matter summons eg.

In its filing Malaysia cited three documents recently declassified by the United Kingdom to support the application. The proper procedure for filing a civil suit is provided under Code of Civil Procedure 1908. Waived off completely for taxpayers in certain districts of the flood-affected States and all districts of JK.

I just wanted to follow up to note to be especially careful any time you have an inventor from India as the penalties for an Indian inventor can. A legal notice Dt30-07-2019 was issued to the company.

How To Fix A Mistake In Your E Filing For Malaysians By Juinn Tan Medium

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Pin On Cheap Stock Photos For Sale

How To File Your Taxes If You Changed Or Lost Your Job Last Year

How To Step By Step Income Tax E Filing Guide Imoney

Mygov Public Service Delivery And Local Government Eservice Delivery G2c Lhdnm E Filing

15 Help With Completing Form 1040x Free Tax Filing Filing Taxes Income Tax Preparation

How To Step By Step Income Tax E Filing Guide Imoney

7 Tips To File Malaysian Income Tax For Beginners

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

7 Tips To File Malaysian Income Tax For Beginners

How To Step By Step Income Tax E Filing Guide Imoney

Ada Yang Dah Plan Nak Bercuti Tahun Depan Nah Admin Dah Siapkan Kalendar Cuti 2019 Ikut Negeri Kalendar Cuti Sarawak 2019 Malaysia Sarawak Places To Visit

Inedito Mercedes Classe A Sedan E Revelado Na China Mercedes Mercedes Benz

How To File Your Taxes If You Changed Or Lost Your Job Last Year

Guide To Using Lhdn E Filing To File Your Income Tax

How To Step By Step Income Tax E Filing Guide Imoney

News Paper Jobs News Editor Sub Editor City Reporter Staff Reporter Required Apply Now Sales And Marketing Jobs Online Data Entry Jobs Data Entry Jobs

Samsungm32 Short Video Galaxym32 Techtalks Samsung Galaxy M32 Short Video More Samsung Galaxy Phone Samsung Galaxy Samsung